Readers, thank you for coming on this journey with me through the Six Stages of Health Tech grief. Alas, we’re finally at the end.

I hope you’ve enjoyed the series as much as I’ve enjoyed receiving your emails that painfully empathize with it. If you want to see the other posts, here are the others.

Part 1 - Paying patients to do healthy things and building new EMRs

Part 2 - Selling to self-insured employers

Part 3 - Entrenched interests and why it’s the best time to start a health tech company

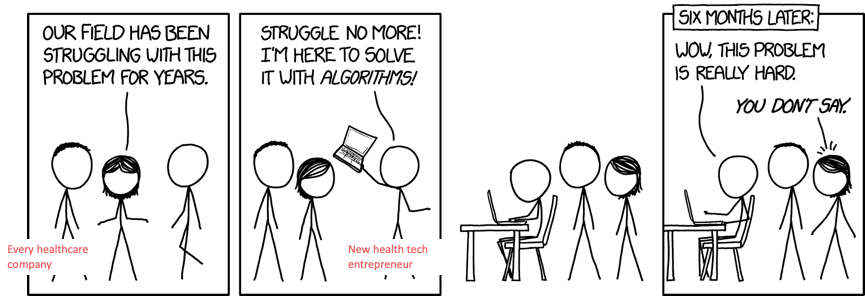

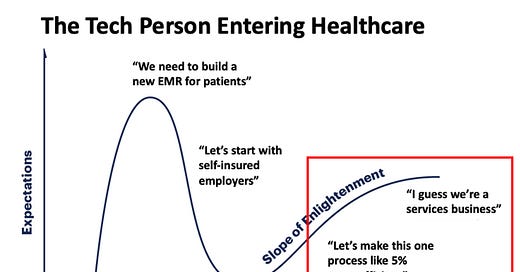

So what happens when an entrepreneur stops crying themselves to sleep and gets out of the trough of disillusionment?

“Let’s make this one process 5% better”

When a company gets out of the trough, many think that the best way forward is to focus very specifically on a singular pain point one their target customers feel and make that process a bit better with software.

“We can make your patient outreach more efficient with our software.”

“We can mine your disparate internal data sources to identify the most at-risk patients for you.”

“We use your data with our algorithms to help you identify the most promising drug candidates.”

“Our software make it easier for your employees to shop and find the best care when they need it.”

The idea is that there’s some process that’s currently handled with spreadsheets or calls/emails that could be better handled by software. In an ideal world you train users that work at some healthcare company or employer on your platform for X task, they see their time for that task goes down, and then the parent company pays you to make the lives of their employees easier and to speed up some process.

This happens all the time when you work in tech-land at a startup. Want to make your workers more productive with software? Slack, Airtable, Notion, Zapier, JIRA, Monday, and other rainbow-themed productivity tools plug into each other and make you so productive that your entire job just becomes talking about how productive you are. You probably spend more money on the tools than the hours saved.

There’s a few reasons I think this is way tougher in healthcare.

What you think is a lightweight tool that can plug nicely into some process without integrating with too many systems is never as lightweight as you think. If you need to pass data between any two systems, this is going to take time from both you and your customer to get up and running.

In other industries, new companies tend to start by selling to the small-medium sized businesses and iterate features before selling into larger enterprises. In healthcare this is very difficult because most of the small/medium size businesses are getting crushed and have less capacity/resources (money, time, dedicated staff) for experimentation.

The principal-agent problem is everywhere in healthcare. The person making the purchasing decision and the person using the product are totally different. At a hospital the purchaser might be a Chief Information Officer, but the user would be frontline physicians. The CIO cares way more about price + disruption in existing workflow than anything around usability or speed of doing things.

No one wants to learn a new tech tool/process because they’ve historically been terrible. When you say “our tool can do this for you” the other side is hearing “here’s another thing you have to learn after you spent months trying to figure out the last tool”.

But beyond the adoption process, I think a lot of companies trying to sell software tools for a specific use case will also discover that the companies you’re selling to actually can’t use the tools to their maximum because they either don’t have the expertise in-house (e.g. data/tech talent or healthcare knowledge). Or you’ll discover the efficiencies you created with your tool immediately get wiped out once you hit whatever the legacy system/process is.

An example: TrialSpark initially started as a patient recruitment service that would recruit patients online send them to clinical trial sites. However, the company discovered that a lot of the patients weren’t actually being handed off properly, because the sites had a bunch of their own systems and processes to handle clinical trial recruitment and simply increasing the top of the funnel of eligible patients wasn’t making the system as a whole more efficient. TrialSpark realized that in order to make clinical trials more efficient, it had to control more of that process including becoming the trial site itself and actually delivering services to run trials.

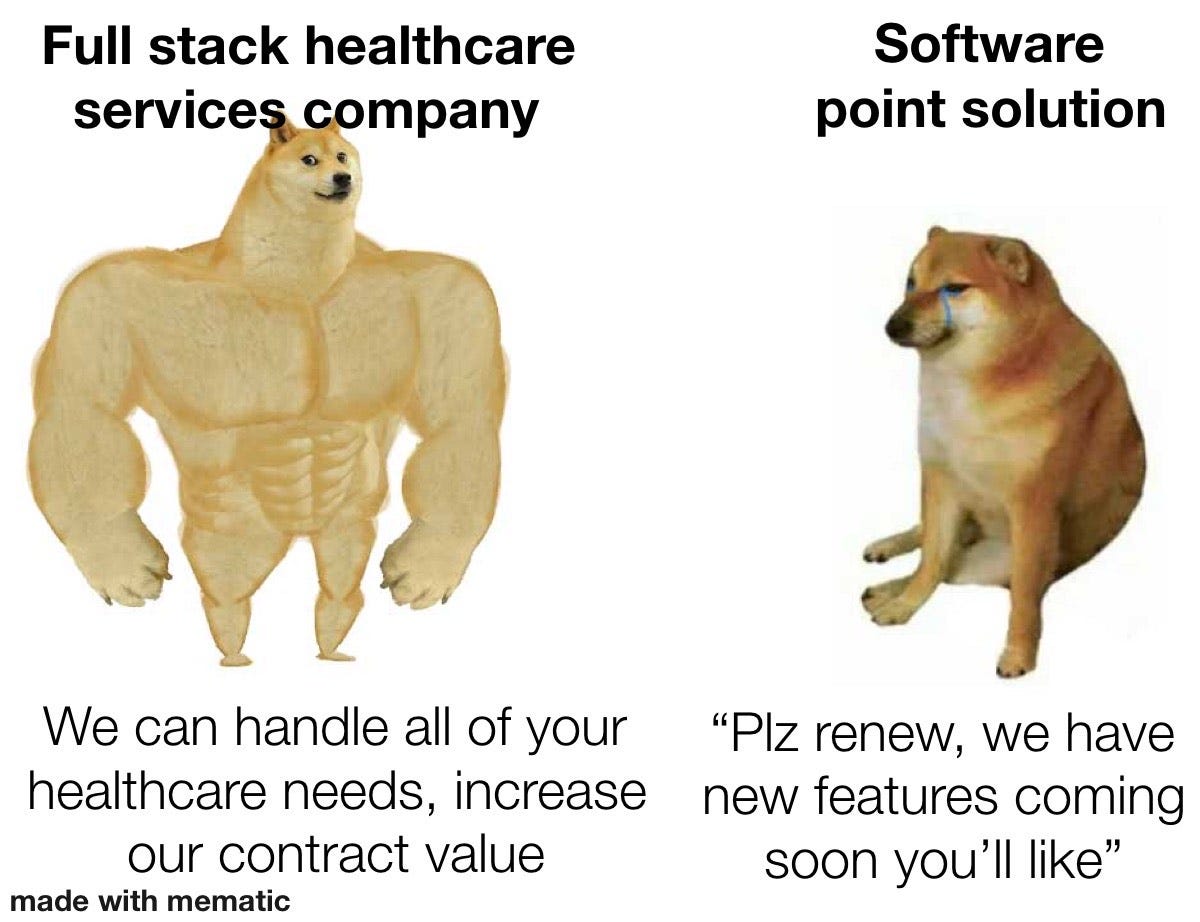

I would guess many companies in the “slightly more efficient” bucket will end up discovering that they have to loan people out to help their clients make the most of their tool, or they’ll realize that it makes more sense to actually compete with their clients and become more of a full-stack services company.

Or they’ll just remain one of these zombie $1M-$5M ARR companies with like 1 or 2 key clients that stays in relative purgatory.

“I guess we’re a services company”

If you think you’re going to build a self-serve software tool with a steady 80-85% gross margin from the jump, I have some bad news for you. Most companies will realize that they have to deliver services if they want to generate meaningful revenue.

I think a lot of people coming from tech to healthcare try to stick with the maxim that services are something aren’t scalable or defensible + it makes your company more liable and at-risk.

I would argue one of the most powerful forms of defensibility in healthcare is trust. In an industry where the downside risk of things messing up is very high and everything is super complicated, trust is the most valuable form of currency. Contracts are renewed and expanded because a vendor is trusted. Selling complex products that are not simply digitizing one process within a workflow requires trust. Getting patients to come to you first when they have a question is because they trust you.

One part of trust is tying yourself to the outcomes of the end buyer. I talked about talking on more outcomes-based risk as a differentiator in the last post of this series. But if you’re tying yourself to the outcome, do you really want to outsource the client-facing part and care delivery to someone else?

IMO services are a core part of building that trust. Two main ways this can manifest.

Services Help Scale Tech Products

Digital health companies will use professional services to help on-board, train, and set up a company onto their platform. Companies like Veeva and Health Catalyst have done this well.

When we started the company, the plan was to build products and have partners deliver all the surrounding services. Very quickly, we learned that our customers wanted more Veeva “skin in the game.” So, initially we built our services division to demonstrate our commitment to customer success but it became much, much more than that.

The Veeva Professional Services team is now the glue that holds us close to our customers around the world…This crucial team is part of every major implementation and quickly becomes trusted advisors and partners for our customers. - Matt Wallach, co-founder of Veeva

Veeva sells a whole suite of cloud-based software tools to life sciences companies, including the software you need to run a clinical trial, sell your drugs, be compliant with regulations, etc.

In 2009, Veeva got about about 50% of its revenue from services (20-25% gross margin) and the other half from subscription software (75-80% gross margin). Today, Veeva gets ~80% of its revenue from software via up-selling into new products across divisions within life science companies, from R&D through commercial. Their subscription revenue retention has been 100-120%+ basically every year with an average revenue per customer that blows most SaaS business out of the water. Veeva had the ability to do that because it established trust with its end customers with a hands-on on-boarding, rollout, and customization process of the software and professional services to share learnings from their work with other customers.

You can see another version of that story with Health Catalyst and the providers they work with as well. Health Catalyst sells data warehousing services to hospitals and providers, which basically brings the random disparate sources of data floating around a health system and puts it in one, structured place so that you can run analytics, see how your hospital is performing across departments, etc. They also provide services which includes data teams to help hospitals get set up, run different analyses, etc. if they don’t have the expertise/bandwidth in-house.

In Health Catalyst’s S-1 they explicitly talk about how services build trust in their pseudo-mandated S-1 flywheel graphic. That trust allows them to expand into new departments within the hospitals and types of products they can sell. Hospitals are now outsourcing entire analytics departments to Health Catalyst, and the company can use its relationships + access to the providers data to offer scalable, higher margin data products to pharma, insurance, etc. Similar to Veeva, their services revenue is becoming a smaller % of their total revenue while their higher margin technology product lines are growing quickly.

Tech Helps Scale Services Products

Services can also BE the core product. I feel like tech-land forgets that you can build really big services businesses.

Livongo and One Medical are good examples of this. They’ve built businesses that sell their services, and use tech to do it deliver it more efficiently and with a better experience for the end patient.

Livongo is a good case of how delivering on outcomes for their customers let them expand into new areas. Livongo started by helping employers manage their employees with diabetes via remote monitoring, coaching, texting, emails, etc. But their success in that area is what let them expand into other chronic disease areas (behavioral health, hypertension, etc.). Two separate points from their earnings call:

[1] First, as the number of employee health management programs continue to grow, large employers are increasingly challenged to organize and manage these programs for their employees.

They want one partner to work with. This trend was already under way before COVID-19, but the pandemic accelerates it…

[2] And because of our virtuous business model, our clients don't just like us, they love us. We deliver strong clinical outcomes and a hard financial ROI. And that's exactly what the market is looking for, but they're looking for a safe choice. And I was on the phone with one HR Benefits Director recently, and they said, "You don't get fired for buying Livongo." And that was just here recently. - Zane Burke, Livongo CEO

Services helped Livongo establish itself as a safe choice so that it could expand its footprint within each customer. Now it becomes easier to sell the package of “we’ll take care of all of your chronic disease patients”. If healthcare isn’t your expertise (patients, HR teams, etc.) then you don’t want to run a diligence process for every single different healthcare problem you face. You want one company that’s worked well and trusted by others to handle things for you.

The other benefit of actually delivering the service yourself is that you can create a services workflow that is built with the tech in mind instead of handing it off to some third-party to deliver services. This will not only actually reduce your operating cost as you scale, but is super important if you’re in a contract where you’re paid on outcomes or you’re differentiating yourself on the patient experience. As you get data on how patients are using your product, you’ll want to make changes to how care is delivered which is way harder if you don’t control the services portion.

Livongo’s (hopefully ironically named) AI + AI system literally stands for Aggregate, Interpret, Apply, and Iterate. As data comes in from the connected devices, they can better timed nudges and tailor the coaching. And if you do the nudges appropriately, you can likely scale the coach:patient ratio significantly.

One Medical seems to be heavily leaning into digital visits, which would be way cheaper and more scalable for them operationally (e.g. “see” more patients asynchronously via text, use lower cost labor when possible, fill unused capacity when the physicians have down time in-office, etc.). Again, by controlling tech AND services together, they can drive down operational expenses like that and try these different workflows.

Services Takeaways

Do you NEED to be a services company to be successful in healthcare? No. But having a services component lets you do the following things:

Have a greater control over the consistency of service quality for your end customer. This builds trust with them, which is important.

More easily guide your customers to new, potentially higher margin products that you’re expanding into that might be relevant for them. Most customers don’t want to deal with a million different solutions that don’t talk to each other, they want a single service that can fulfill whatever the job to be done is.

Have customers outsource functions to you that they don’t have expertise in-house. You can take a much larger and stickier contract if they outsource departments or personnel to you, and you get the operational benefit of having those experts work across multiple customers.

Accrue the efficiencies that tech can bring. If you’re just selling a tool then eventually you’ll handoff to the legacy healthcare system and most of those efficiencies will vanish. If you build a tech-enabled service from the ground up, you can build workflows for the services component that actually take advantage of the tech.

So if you get to a point in the health tech journey where you realize that you might you might actually need more humans than you thought, don’t despair! And if anyone tries to tell you that what you’re doing isn’t scalable, send them this post and then walk away.

Conclusion - The Health Tech Idea Maze

It’s funny, when this stages of grief meme started making the rounds people assumed it was me scoffing at the hubris of tech people entering healthcare. That’s not true at all.

This thought process is the idea maze for almost everyone new to healthcare, and going through it means that person is asking the correct questions IMO. If we want to fix the system, we need people that are constantly asking why things are the way they are.

The point of this series was just to accelerate the process and give my answers to common questions that come up. But it’s not meant to discourage tech people from entering healthcare. Actually the opposite - I think those people will eventually ask exactly the right question that opens the opportunity to a massive new company.

So keep chugging, and I hope more tech people enter healthcare to try and solve it. In fact, that’s the whole goal of Out-Of-Pocket :)

Thinkboi out,

Nikhil aka.

Twitter: @nikillinit

If you’re enjoying the newsletter, do me a solid and shoot this over to a friend or healthcare slack channel and tell them to sign up. The line between unemployment and founder of a startup is traction and whether your parents believe you have a job.

Interesting to see the build out and expansion of services programme within EHR companies themselves in the past decade. To your article's point, as the main frigging software of a healthcare organization, they've built out a lot of trust so it becomes a game of "now that you've solved that, solve all my problems"

Services act as the lubricant to make the product experience smooth enough to seem the platform that most health tech companies aspire to be.

Have to be really successful as a company to slowly wean yourself off that teat